All Categories

Featured

Table of Contents

These financiers are assumed to have the economic refinement and experience needed to evaluate and spend in high-risk investment possibilities unattainable to non-accredited retail financiers. In April 2023, Congressman Mike Flood introduced H.R.

Preferred Accredited Investor Property Investment Deals

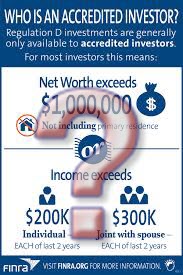

For now, investors must financiers by follow term's existing definition. There is no official process or government accreditation to come to be a recognized financier, a person might self-certify as a recognized financier under existing laws if they made even more than $200,000 (or $300,000 with a partner) in each of the previous 2 years and expect the very same for the existing year.

People with an energetic Collection 7, 65, or 82 permit are also thought about to be accredited financiers. investment platforms for accredited investors. Entities such as companies, partnerships, and trust funds can additionally accomplish certified financier status if their financial investments are valued at over $5 million.

In-Demand Accredited Investor Funding Opportunities

Exclusive Equity (PE) funds have actually revealed exceptional development in recent years, seemingly undeterred by macroeconomic difficulties. PE companies pool capital from recognized and institutional financiers to get regulating rate of interests in fully grown personal business.

In addition to resources, angel investors bring their specialist networks, advice, and know-how to the startups they back, with the expectation of venture capital-like returns if business removes. According to the Center for Endeavor Research, the typical angel investment amount in 2022 was approximately $350,000, with financiers receiving an average equity stake of over 9%.

That stated, the introduction of on-line private credit scores systems and particular niche enrollers has actually made the property course available to individual recognized financiers. Today, capitalists with as low as $500 to spend can take benefit of asset-based exclusive credit rating possibilities, which offer IRRs of up to 12%. Regardless of the increase of e-commerce, physical food store still make up over 80% of grocery sales in the USA, making themand especially the property they run out oflucrative financial investments for accredited capitalists.

Accredited Investor Investment Returns

In contrast, unanchored strip centers and neighborhood centers, the following 2 most greatly negotiated types of realty, tape-recorded $2.6 billion and $1.7 billion in deals, specifically, over the same duration. Yet what are grocery store-anchored centers? Suburban strip shopping malls, outlet malls, and various other retail centers that feature a major food store as the area's main renter usually fall under this group, although shopping malls with enclosed walkways do not.

Certified capitalists can invest in these spaces by partnering with real estate private equity (REPE) funds. Minimum financial investments commonly start at $50,000, while total (levered) returns range from 12% to 18%.

The market for art is likewise broadening. By the end of the decade, this number is anticipated to come close to $100 billion.

Market-Leading Accredited Investor High Return Investments

Financiers can currently own varied exclusive art funds or acquisition art on a fractional basis. These choices feature investment minimums of $10,000 and use web annualized returns of over 12%. Financial backing (VC) proceeds to be one of the fastest-growing asset courses on the planet. Today, VC funds boast even more than $2 trillion in AUM and have actually deployed greater than $1 trillion right into venture-backed start-ups considering that 2018including $29.8 billion in Q3 2023 alone.

A certified financier is a person or entity that is permitted to buy safeties that are not registered with the Stocks and Exchange Payment (SEC). To be an accredited capitalist, a private or entity should meet particular revenue and web well worth standards. It takes cash to generate income, and recognized financiers have a lot more possibilities to do so than non-accredited capitalists.

Approved capitalists are able to invest money straight right into the rewarding globe of private equity, personal placements, hedge funds, equity capital, and equity crowdfunding. The requirements of who can and who can not be an accredited investorand can take component in these opportunitiesare identified by the SEC. There is a typical false impression that a "process" exists for a specific to become a certified investor.

Dependable Venture Capital For Accredited Investors

The burden of showing a person is a recognized investor drops on the investment lorry rather than the financier. Pros of being a certified capitalist consist of accessibility to unique and restricted financial investments, high returns, and increased diversification. Cons of being an approved investor consist of high risk, high minimum financial investment quantities, high charges, and illiquidity of the financial investments.

Rule 501 of Policy D of the Stocks Act of 1933 (Reg. D) offers the interpretation for a recognized capitalist. Put simply, the SEC specifies an accredited investor with the boundaries of revenue and net well worth in 2 ways: A natural individual with income surpassing $200,000 in each of the two most recent years or joint income with a spouse surpassing $300,000 for those years and a sensible assumption of the exact same revenue degree in the current year.

About 14.8% of American Homes qualified as Accredited Investors, and those houses controlled about $109.5 trillion in wide range in 2023. Determined by the SCF, that was around 78.7% of all exclusive wide range in America. Regulation 501 additionally has provisions for companies, collaborations, charitable organizations, and count on addition to firm directors, equity proprietors, and monetary institutions.

High-End Accredited Investor Syndication Deals

The SEC can include accreditations and designations moving forward to be included along with motivating the public to submit proposals for various other certifications, classifications, or credentials to be considered. accredited investor platforms. Employees who are taken into consideration "educated employees" of a personal fund are currently additionally thought about to be accredited financiers in concerns to that fund

People that base their certifications on annual revenue will likely need to send tax obligation returns, W-2 forms, and other records that indicate salaries. Approved capitalist designations additionally exist in various other nations and have similar needs.

In the EU and Norway, for example, there are three tests to establish if an individual is a recognized investor. The initial is a qualitative examination, an assessment of the individual's expertise, understanding, and experience to figure out that they can making their own investment choices. The second is a quantitative examination where the individual needs to meet two of the following standards: Has executed transactions of significant size on the appropriate market at an average regularity of 10 per quarter over the previous four quartersHas an economic profile surpassing EUR 500,000 Functions or has actually operated in the financial sector for at the very least one year Lastly, the client has to state in written form that they intend to be treated as a professional customer and the company they wish to collaborate with should provide notice of the securities they can lose.

Table of Contents

Latest Posts

Auction Foreclosure Tax

Outstanding Tax Liens

Tax Lien Investing Expert

More

Latest Posts

Auction Foreclosure Tax

Outstanding Tax Liens

Tax Lien Investing Expert