All Categories

Featured

Table of Contents

- – Custom Accredited Investor Investment Opportun...

- – Professional Passive Income For Accredited Inv...

- – Preferred Accredited Investor Investment Netw...

- – In-Demand Passive Income For Accredited Inves...

- – Private Placements For Accredited Investors

- – Expert Accredited Investor Opportunities wit...

- – Innovative Accredited Investor Real Estate I...

The laws for accredited capitalists differ amongst jurisdictions. In the U.S, the interpretation of an accredited capitalist is placed forth by the SEC in Policy 501 of Regulation D. To be a recognized financier, an individual needs to have a yearly earnings exceeding $200,000 ($300,000 for joint revenue) for the last two years with the expectation of making the exact same or a higher revenue in the existing year.

This amount can not include a main home., executive police officers, or directors of a company that is providing non listed protections.

Custom Accredited Investor Investment Opportunities

If an entity is composed of equity owners who are accredited capitalists, the entity itself is an accredited investor. Nonetheless, an organization can not be created with the sole objective of buying specific safety and securities - private placements for accredited investors. A person can qualify as a certified capitalist by demonstrating adequate education or work experience in the economic market

Individuals that want to be approved investors do not use to the SEC for the designation. Rather, it is the obligation of the firm offering a private placement to ensure that every one of those approached are approved capitalists. People or events who intend to be accredited investors can come close to the provider of the non listed securities.

For example, suppose there is an individual whose earnings was $150,000 for the last three years. They reported a key residence worth of $1 million (with a home mortgage of $200,000), an automobile worth $100,000 (with an outstanding finance of $50,000), a 401(k) account with $500,000, and a financial savings account with $450,000.

Total assets is determined as properties minus liabilities. He or she's total assets is exactly $1 million. This involves a computation of their properties (besides their main house) of $1,050,000 ($100,000 + $500,000 + $450,000) much less an auto loan equating to $50,000. Because they fulfill the internet well worth demand, they certify to be an accredited investor.

Professional Passive Income For Accredited Investors

There are a few less common certifications, such as managing a depend on with greater than $5 million in possessions. Under federal securities legislations, only those who are approved financiers may join certain protections offerings. These may include shares in personal positionings, structured items, and exclusive equity or hedge funds, amongst others.

The regulators intend to be specific that individuals in these highly dangerous and complicated financial investments can fend for themselves and evaluate the threats in the lack of federal government protection. The accredited investor guidelines are created to safeguard possible financiers with minimal economic knowledge from adventures and losses they may be ill geared up to withstand.

Recognized financiers meet credentials and expert criteria to gain access to exclusive financial investment possibilities. Designated by the United State Securities and Exchange Payment (SEC), they obtain access to high-return alternatives such as hedge funds, equity capital, and private equity. These financial investments bypass full SEC enrollment but carry greater risks. Certified financiers need to meet earnings and internet well worth demands, unlike non-accredited people, and can spend without limitations.

Preferred Accredited Investor Investment Networks with Accredited Investor Returns

Some essential adjustments made in 2020 by the SEC include:. This adjustment recognizes that these entity types are usually utilized for making investments.

This adjustment accounts for the results of rising cost of living with time. These changes increase the recognized capitalist pool by approximately 64 million Americans. This broader accessibility provides a lot more opportunities for investors, yet additionally boosts potential threats as much less economically sophisticated, financiers can get involved. Services utilizing personal offerings may gain from a bigger swimming pool of prospective investors.

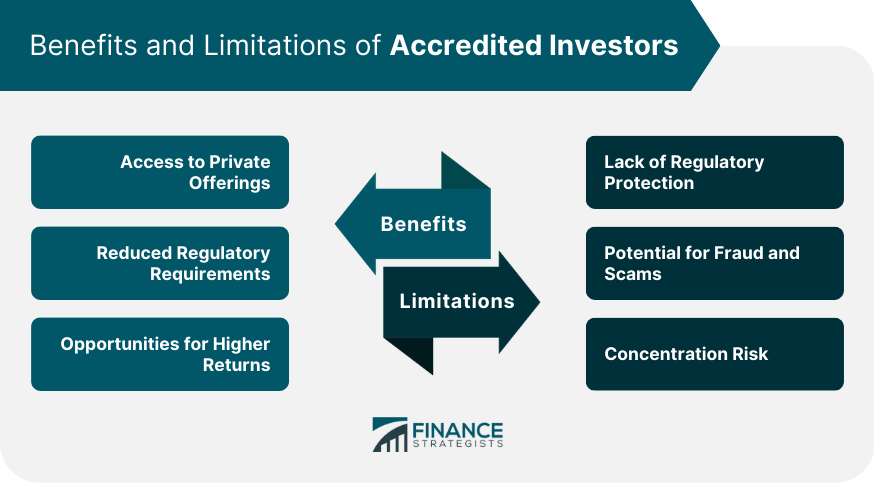

One major benefit is the possibility to purchase positionings and hedge funds. These investment alternatives are unique to recognized capitalists and organizations that qualify as a recognized, per SEC guidelines. Exclusive positionings allow firms to safeguard funds without navigating the IPO treatment and regulatory paperwork needed for offerings. This provides recognized investors the possibility to spend in arising firms at a phase before they take into consideration going public.

In-Demand Passive Income For Accredited Investors

They are checked out as financial investments and come just, to qualified clients. Along with recognized companies, certified investors can choose to purchase startups and promising endeavors. This provides them tax obligation returns and the opportunity to go into at an earlier phase and potentially enjoy rewards if the business thrives.

However, for investors open up to the risks included, backing startups can lead to gains. Most of today's technology business such as Facebook, Uber and Airbnb originated as early-stage start-ups supported by certified angel investors. Advanced investors have the opportunity to explore investment alternatives that might yield much more earnings than what public markets provide

Private Placements For Accredited Investors

Although returns are not assured, diversity and portfolio improvement options are expanded for financiers. By diversifying their profiles through these increased investment opportunities certified investors can enhance their approaches and potentially accomplish remarkable long-lasting returns with proper threat management. Experienced investors usually encounter investment choices that may not be conveniently offered to the basic capitalist.

Investment choices and protections supplied to accredited financiers normally involve greater dangers. Private equity, endeavor resources and bush funds typically focus on spending in possessions that lug risk yet can be sold off easily for the opportunity of better returns on those high-risk investments. Looking into before spending is critical these in situations.

Secure periods protect against financiers from taking out funds for even more months and years on end. There is also far much less openness and regulative oversight of exclusive funds contrasted to public markets. Financiers might battle to precisely value private assets. When dealing with dangers certified financiers require to evaluate any private financial investments and the fund managers included.

Expert Accredited Investor Opportunities with Accredited Investor Support

This adjustment may extend accredited financier standing to an array of individuals. Permitting partners in dedicated connections to combine their resources for shared qualification as recognized financiers.

Making it possible for individuals with particular specialist certifications, such as Collection 7 or CFA, to qualify as certified financiers. This would certainly identify financial sophistication. Creating extra needs such as proof of financial proficiency or efficiently finishing an accredited capitalist examination. This can ensure capitalists comprehend the dangers. Restricting or removing the main home from the net well worth estimation to reduce possibly inflated analyses of riches.

On the various other hand, it can additionally lead to skilled investors thinking excessive dangers that might not appropriate for them. So, safeguards might be needed. Existing recognized investors may deal with boosted competitors for the very best investment chances if the swimming pool grows. Business elevating funds might take advantage of a broadened accredited investor base to attract from.

Innovative Accredited Investor Real Estate Investment Networks for Exclusive Opportunities

Those who are presently considered certified investors have to stay upgraded on any type of changes to the criteria and laws. Companies looking for recognized financiers need to remain watchful about these updates to guarantee they are bring in the best target market of investors.

Table of Contents

- – Custom Accredited Investor Investment Opportun...

- – Professional Passive Income For Accredited Inv...

- – Preferred Accredited Investor Investment Netw...

- – In-Demand Passive Income For Accredited Inves...

- – Private Placements For Accredited Investors

- – Expert Accredited Investor Opportunities wit...

- – Innovative Accredited Investor Real Estate I...

Latest Posts

Auction Foreclosure Tax

Outstanding Tax Liens

Tax Lien Investing Expert

More

Latest Posts

Auction Foreclosure Tax

Outstanding Tax Liens

Tax Lien Investing Expert